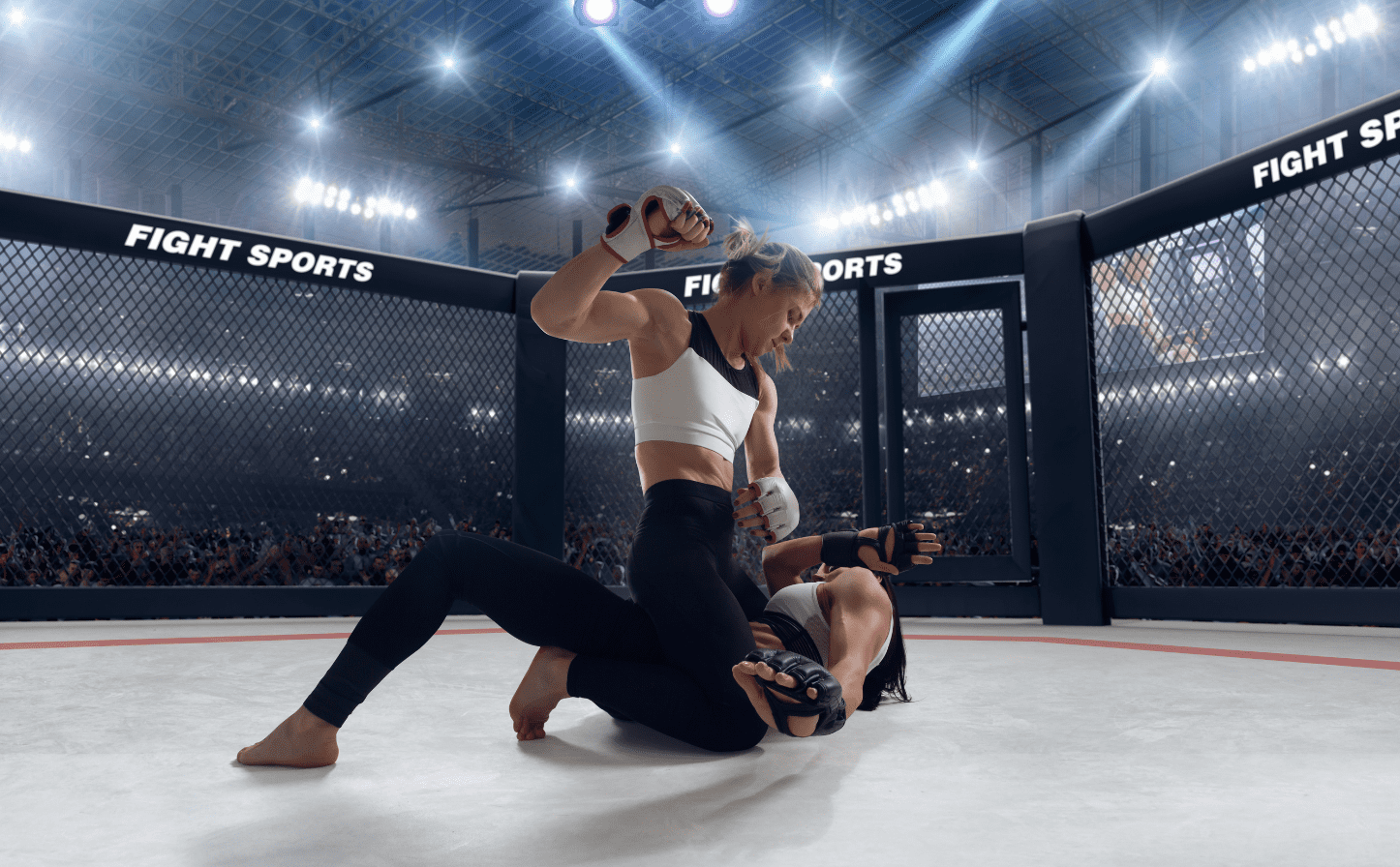

Competitive athletes push their bodies to the limit, striving for peak performance and that coveted win. But with intense training and competition comes the ever-present risk of injury.

A serious injury can not only sideline you from the sport you love but also rack up significant medical bills, endangering your financial stability and potentially derailing your athletic career.

That’s where sports injury insurance steps in. In this blog, we’ll explore the top 5 reasons why competitive athletes should consider sports injury insurance as a crucial part of their training regimen.

1. Financial Protection from Medical Expenses

Injuries are a common occurrence, and the medical bills associated with them can be a knockout blow to your finances. Here’s where combat sports injury insurance acts as your financial cornerman.

Unlike traditional health insurance, combat sports insurance is specifically designed to cover medical expenses directly related to injuries sustained during training or competition. This can include:

- Hospital stays: If a serious injury requires hospitalisation, your insurance can help cover the room, board, and associated medical costs.

- Surgery: Whether it’s a torn ACL reconstruction or facial surgery due to an accidental headbutt, combat sports insurance can help offset the often steep costs of surgery.

- Rehabilitation: Getting back in the ring after an injury often requires extensive physical therapy. Combat sports insurance can help cover these crucial rehabilitation expenses.

By having this financial safety net in place, you can focus on recovery without worrying about the mounting medical bills. This allows you to prioritise your health and get back to training and competing sooner.

2. Ensuring Proper Rehabilitation and Recovery

Extensive physical therapy, specialist appointments, and other forms of rehab can be expensive. This is where sports injury insurance becomes a must-have for competitive athletes.

Here’s why:

- Without insurance, the cost of rehab can be a major barrier to receiving the best possible care. Sports injury insurance helps remove this financial hurdle, allowing you to access the top specialists, therapists, and treatment facilities you need to heal properly. This can significantly improve your recovery time and overall outcomes.

- Worrying about medical bills during recovery can hinder your progress. Sports injury insurance coverage takes that financial stress off your shoulders, allowing you to focus solely on getting better. This mental clarity can be a game-changer, enabling you to fully dedicate yourself to the rehabilitation process.

- Skipping or skimping on rehab due to cost concerns can lead to long-term complications that could sideline you permanently. Sports injury insurance helps ensure you can complete your rehab program without financial limitations, minimising the risk of these complications and maximising your chances of a full and successful return to competition.

By prioritising proper rehabilitation with the support of sports injury insurance, you’re investing in your future as a competitive athlete. You’ll be back in the ring stronger, faster, and ready to dominate.

3. Potential Coverage for Loss of Income

Many sports injury insurance policies offer coverage for loss of income due to a covered injury.

This means that if your injury prevents you from competing and earning prize money, sponsorships, or other income associated with your athletic career, the insurance can help replace a portion of your lost income. This financial support can be a lifeline during your recovery, allowing you to focus on healing without the added stress of financial hardship.

Here’s why having this coverage is crucial:

- Peace of Mind During Recovery: Knowing that a portion of your income is still coming in can alleviate significant financial anxiety during your recovery. This peace of mind allows you to focus on getting better and avoid rushing back to competition before you’re fully healed, which can lead to further complications.

- Maintaining Financial Stability: Medical bills and lost income can wreak havoc on your financial stability. Sports injury insurance for athletes with loss of income coverage can help bridge the gap, ensuring you can cover your essential expenses while you’re sidelined.

- Supporting Your Training: Even while recovering from an injury, you may still need to invest in training activities that don’t exacerbate your injury. This could include things like nutritional coaching, specialised training methods, or mental performance training. Loss of income coverage can help ensure you have the resources to continue these essential activities and maintain your competitive edge.

By providing a financial safety net in case of lost income, sports injury insurance demonstrates its value as more than just medical expense coverage. It’s a comprehensive safety net that safeguards your financial well-being and supports your long-term athletic career.

Ready to find the best sports injury insurance to protect your passion and future? Explore your options and get a free quote today!

4. Peace of Mind and Focus on Training

Knowing you have a financial safety net in place can significantly reduce anxiety and stress related to injuries. This translates to:

- Improved Focus: Without the financial burden of potential medical bills or lost income looming over you, you can train with a clear mind and focus solely on honing your skills and perfecting your techniques.

- Enhanced Confidence: The knowledge that you’re protected in case of injury can boost your confidence and allow you to push yourself harder during training, knowing you can afford to recover properly if needed.

- Reduced Performance Anxiety: The fear of injury can lead to performance anxiety, hindering your ability to perform at your best. Sports injury insurance can help alleviate this anxiety, allowing you to compete with a clear head and unleashed fighting spirit.

5. Customised Coverage for Combat Sports

Combat sports are unique in their intensity and the specific types of injuries they present. Unlike a general sports injury insurance policy, competitive sports insurance offers customised coverage designed to address the specific needs of athletes in these disciplines.

Here’s what sets combat sports insurance apart:

- Specialised Coverage: These policies typically cover a wider range of injuries commonly seen in combat sports, such as concussions, ligament tears, and facial injuries.

- Event Coverage: Many plans offer coverage for injuries sustained not just during training, but also during sanctioned competitions.

- Flexible Options: Combat sports insurance providers often allow you to tailor your coverage to your specific needs and level of competition. This means you can choose the level of coverage that best suits your budget and risk profile.

By opting for customised combat sports insurance, you get a policy that truly understands the risks inherent in your chosen sport and provides targeted financial protection.

Combat sports are a test of skill, grit, and determination. But even the toughest athletes can be sidelined by injuries. Don’t let a financial blow follow a physical one.

For comprehensive and customised combat sports insurance solutions in Australia, look no further than Combat Sports Insurance

Get a free quote today and ensure you have the financial protection you need to train hard, recover effectively, and dominate the competition.

Protect your passion. Protect your future. Get Combat sports insurance today!

Read More

Injury insurance for athletes – understanding coverage options for professional and amateur competitors. Professional athlete insurance coverage for injuries and loss of income

Note: The material offered here is for informational purposes only. It does not constitute legally binding advice and should not be a substitute for a consultation with an insurance expert.